Keep your policy.

Transform your KYC process.

Keep your policy.

Transform your KYC process.

With the Blacksmith KYC platform you can

- Realise operational efficiencies in your KYC process

- Secure regulatory compliance and risk reduction

- Unburden and empower compliance staff

- Be up and running within days

How our product transforms your KYC process?

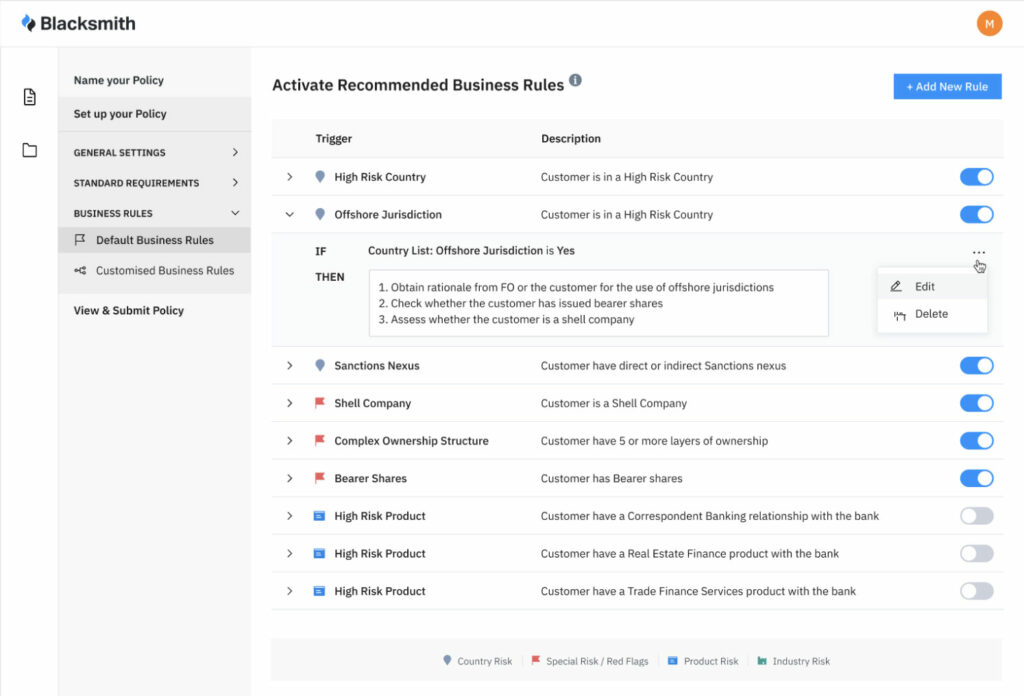

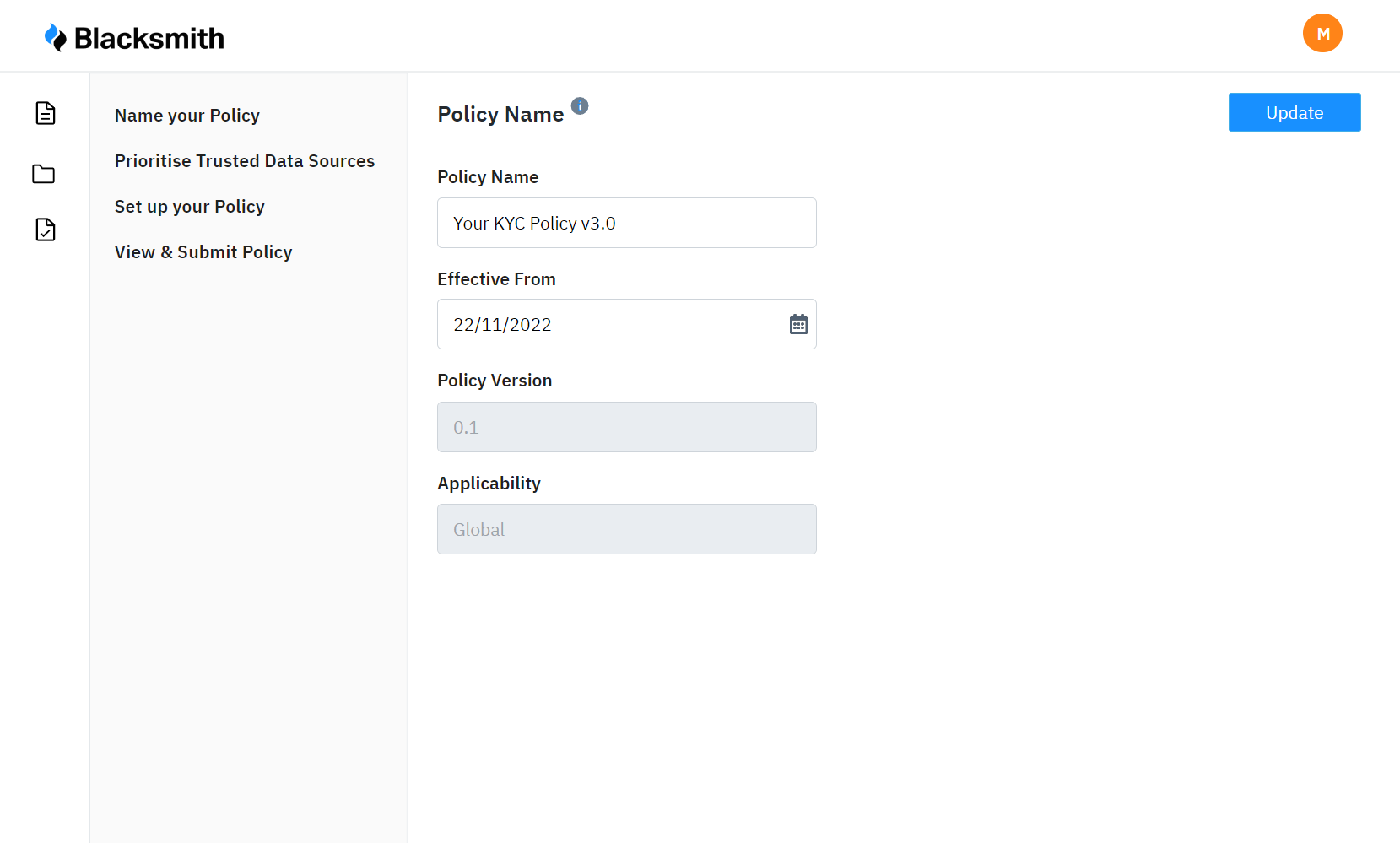

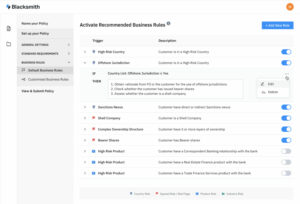

Our solution automatically applies your KYC policy in the KYC review process. Policy compliance is enforced by the platform throughout the whole KYC process. In this way, Blacksmith’s Digital Policy Manager enables you to minimise compliance risks.

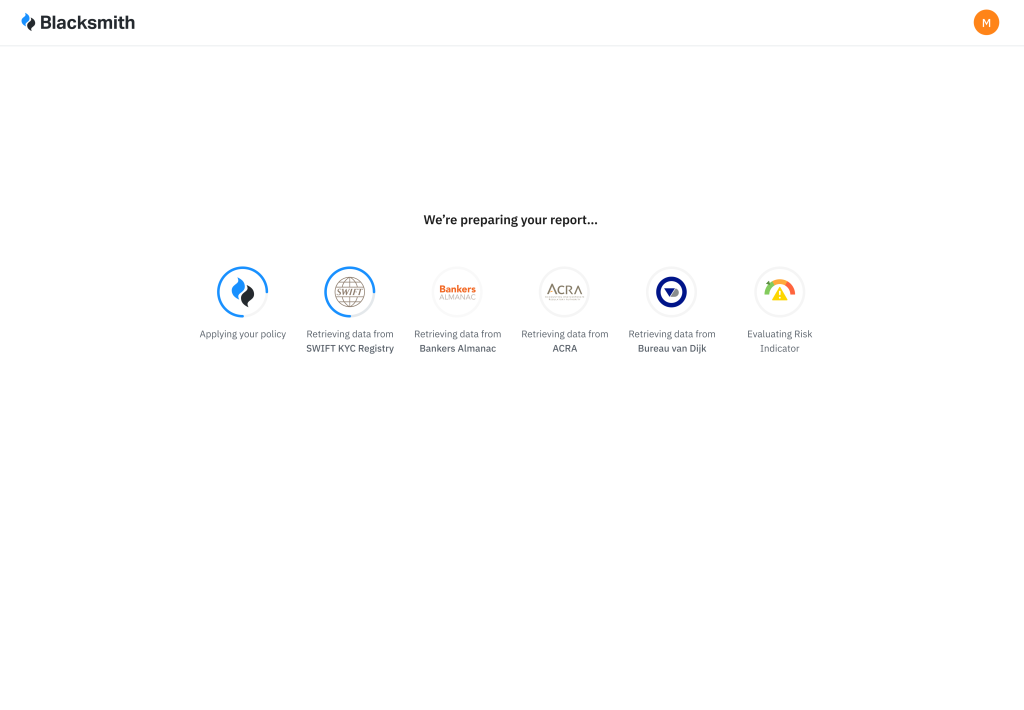

With Blacksmith's DataHub, you can easily plug in any source of data to put together a complete overview of your client. Blacksmith already provides access to a number of leading data aggregators. Information is gathered according to your policy so that you can focus on the most relevant data.

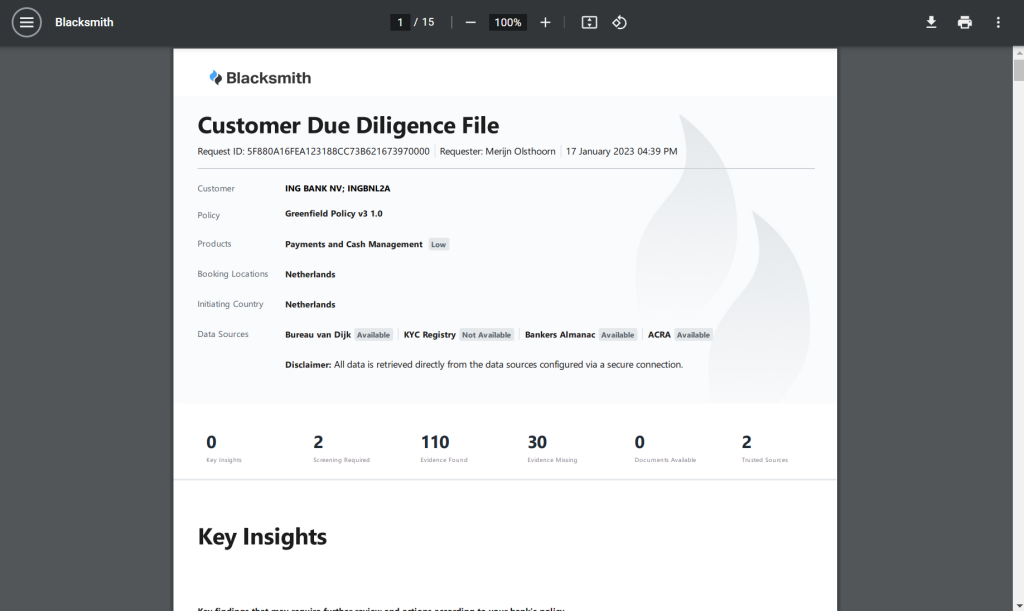

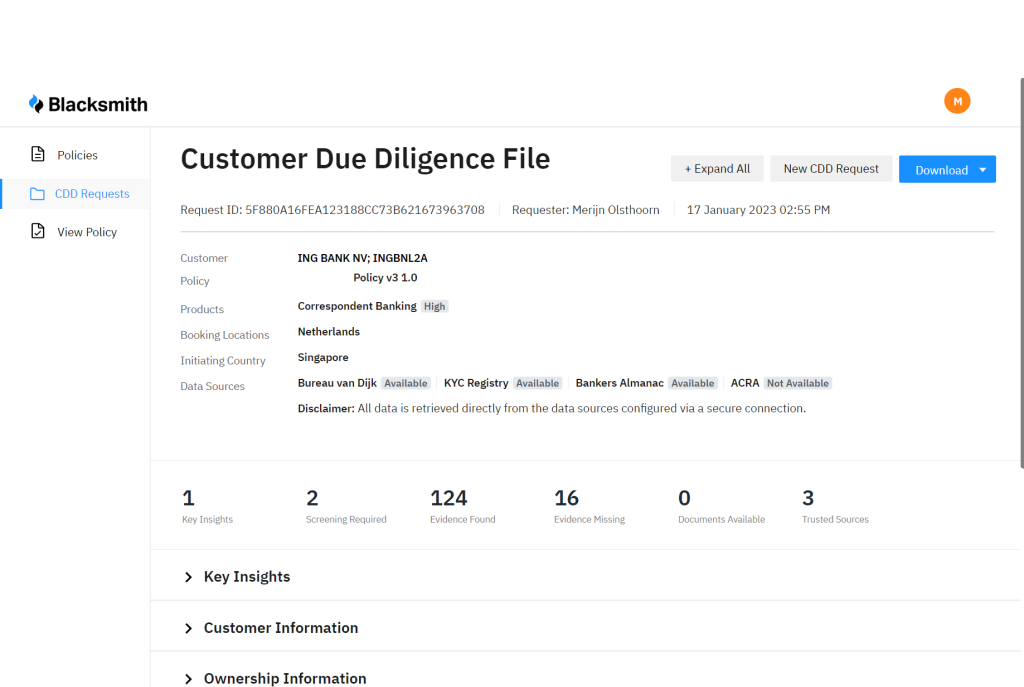

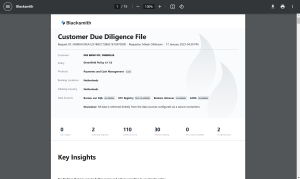

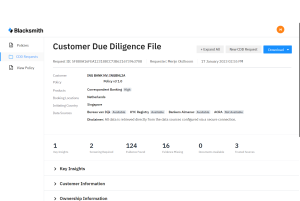

Our CDD File Generator creates customised customer due diligence files with data, insights and evidence driven by your own unique KYC policy settings. Actionable and standardised! You can download the CDD file as a PDF or import it directly into your workflow system via our APIs.

All data extracted from our platforms are provided with auditability of data sources. Blacksmith generates a ready-to-use audit trail to meet regulatory requirements. With Blacksmith you can standardise your CDD files to facilitate quality control.

Blacksmith delivers plug-and-play implementation with our web-based platform, and ready-to-use API connections to your trusted data sources and existing CLM and workflow solutions. Our customer success team ensures that the Blacksmith solution is tailored to your requirements and up and running in a matter of days.

Three modules in one product

The core of our product is the Digital Policy Manager, an easily configurable business rules engine that digitalises your KYC policy and applies this throughout the CDD process.

The DataHub collects and processes relevant data from data vendors, corporate registers, regulators and internal sources based on your KYC policy.

The CDD File Generator creates customised and standardised customer due diligence files with data, insights and evidence, driven by your unique policy settings.

Why we developed Blacksmith

Exponential increase in

KYC-related costs

Financial institutions are required to perform an extensive Customer Due Diligence investigation when onboarding new clients as well as during the client life cycle. CDD investigations and periodic reviews are labour-intensive, time-consuming, voluminous and costly.

Inadequate control of

the KYC process

Increasing regulatory pressure, in combination with a constantly changing risk environment and an inefficient manual KYC process, is resulting in unacceptable compliance risks and inadequate control of the whole KYC process.

Cumbersome policy guidelines and data overload

KYC analysts are currently facing the daunting task of manually searching dozens of public sources to find up-to-date, publicly available data on customer and evidence which they then have to match with complex and detailed policy instructions.

Never ending KYC IT implementations

KYC IT implementations tend to be complex, disruptive, lengthy, and costly. In addition, your organisation will still lack unique KYC policy implementation capabilities to realise operational efficiencies and reduce regulatory compliance risks.

Hear a client perspective of what Blacksmith brings

“Blacksmith facilitates

A more structured approach to KYC

Consistency and completeness

And a better quality output”

Anthony van Vliet – Head of KYC ING Wholesale Bank

Your entire KYC team can benefit from using Blacksmith

Compliance Officers

Control KYC policies and quickly implement regulatory changes in your processes. Minimise compliance risks from policy updates.

KYC operations

Realise operational efficiencies in desk research, data collection and completing your CDD files. Reduce tedious repetitive manual work and increase employee satisfaction.

Front office / client outreach

Accelerate customer onboarding and reduce client outreach to the absolute minimum, thereby improving the customer journey.

Head of KYC

Empower and unburden your teams, realise costs savings, and improve quality in your end-to-end KYC process.

We believe in the power of partnering

At present, no single vendor is able to fully solve the whole KYC challenge for financial institutions. To offer the most optimal end-to-end KYC solution, Blacksmith teams up with leading data aggregators, platform distribution partners and system integrators in the KYC domain to transform your KYC process.

Highlighted News

Encompass Corporation acquires CoorpID and Blacksmith KYC from ING to develop revolutionary Corporate Digital Identity platform

London, New York, Amsterdam and Singapore – January 16th 2024 Encompass Corporation, the global provider of real-time digital Know Your Customer (KYC) profiles, has acquired …

APIs are paving the way for digital transformation

An Application Programming Interface (or API) is a way for two or more computer programs to communicate with each other and transfer data. API …

SEB & Blacksmith KYC: from pilot project to successful implementation

The leading Nordic corporate bank SEB and Blacksmith KYC embarked on a KYC improvement journey together exactly one year ago. So why did SEB choose Blacksmith as a …